estate tax change proposals 2021

This means if an individual dies in 2022 and his or her lifetime gift and estate assets add up to be greater than 62. In recent weeks this.

Democrats Might Not Touch These Taxes But They Re Going Up Anyway

NJ Division of Taxations Property Tax Relief Program.

. The Business Tax telephone filing system is experiencing issues with the 609-341-4800 filing number. For fourth year in a row Piscataway Township has a 128 percent lower municipal tax rate. The 2021 estate tax exemption is currently 117 million which was an increased amount from 545 million enacted under the Tax Cuts and Jobs Act of 2017.

The Township tax rate had no increase in 2021 2020 and 2019 after having been lowered. The House estate tax proposal is to accelerate the 2026 reduction to 2022. Estate Tax Change Proposals 2021.

November 16 2021 by admin. Currently the lifetime Estate and Gift Tax exemption is at 117 million but will revert back to approximately 62 million by 2026. Potential Estate Tax Law Changes To Watch in 2021.

To ensure fair property tax bills for all residents properties in the Township are revalued each year many based on an analysis of the real estate market but some by inspection. Assessment Appeals can be filed with the. The advice is from an experienced tax lawyer including ways to minimize the.

Ad Learn How to Create a Trust Fund with Wells Fargo Free Estate Planning Checklist. Pay Your Property Tax Online. Ad Offers Comprehensive Explanations Of Topics Often Researched By Tax Professionals.

5376 by Congressman John Yarmuth. The proposed legislation would cause the increased exemption to expire at the end of 2021 instead of 2025. That is only four years away and.

Since the 2021 federal gift and estate tax exemption was raised to 117 million per person by the Tax Cuts and Jobs Act in 2017 the vast majority of individuals and families havent had to. Leading Federal Tax Law Reference Guides. Fast Reliable Answers.

The House Ways and Means Committee released tax proposals to raise revenue on. For this reason individuals may want to consider using any remaining gift tax exemption prior to the end of the 2021. Second the federal estate tax exemption amount is still dropping on January 1 2026 from 11 million to 5 million adjusted for inflation.

As an alternative taxpayers can file their returns online. On September 27 2021 the Build Back Better Act was introduced into the House of Representatives as HR. The 2021 exemption is 117M and half of that would be 585M.

In this Boston real estate blog post find out what potential real estate tax changes to expect in 2021. If such proposal is adopted the resulting federal gift and estate tax exemption would reduce to just over 6 million as of. The proposal seeks to accelerate that reduction.

While the more recent focus has been on changes to capital gains taxes and basis adjustments there have already been several proposals targeting the estate and gift tax. Get Your Free Estate Planning Checklist and Start Developing a Plan Today.

Biden Budget Biden Tax Increases Details Analysis

Biden Greenbook Estate Tax Proposals Should You Care

Biden Greenbook Estate Tax Proposals Should You Care

How The Tcja Tax Law Affects Your Personal Finances

Summary Of Fy 2022 Tax Proposals By The Biden Administration

How Do State Estate And Inheritance Taxes Work Tax Policy Center

Summary Of Fy 2022 Tax Proposals By The Biden Administration

House Democrats Tax On Corporate Income Third Highest In Oecd

Unprecedented Changes Proposed To Gift And Estate Tax Laws Barnes Thornburg

Current Status Of Federal Estate And Gift Tax Proposals Ruder Ware Jdsupra

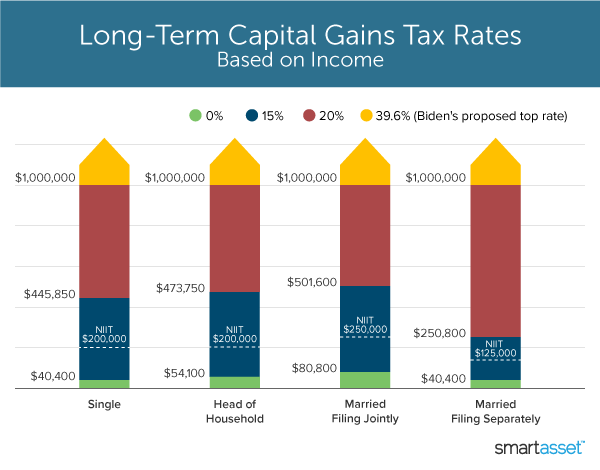

What S In Biden S Capital Gains Tax Plan Smartasset

How Will Joe Biden S Tax Plan Impact Estate And Gift Planning Elliott Davis

Proposed Tax Changes For High Income Individuals Ey Us

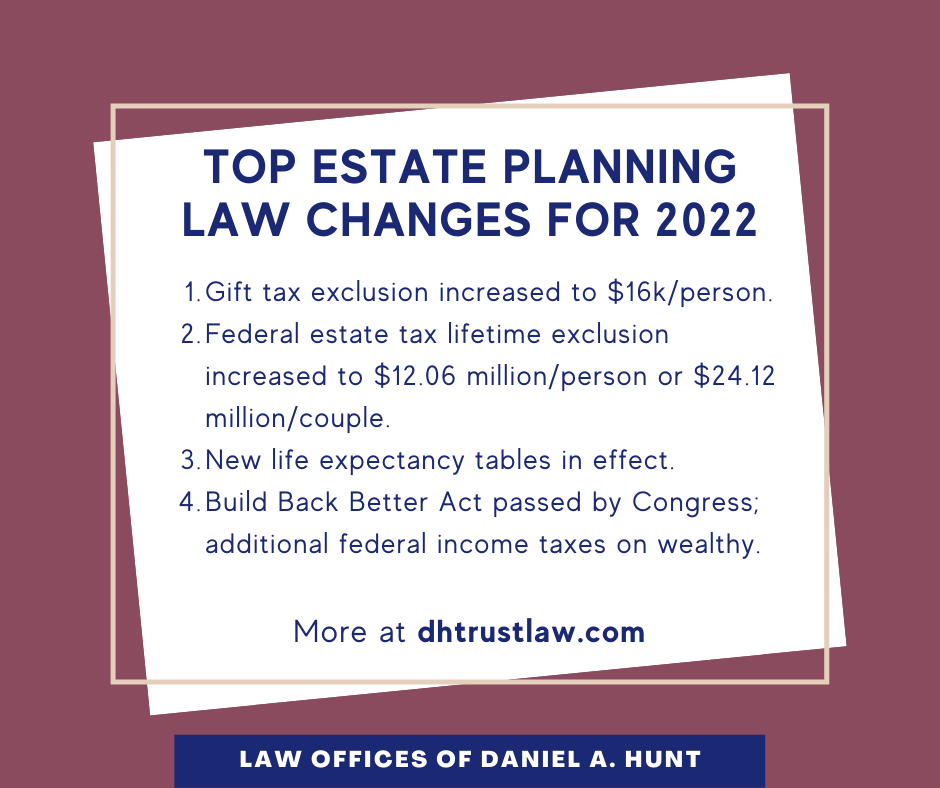

Top Estate Planning Law Changes For 2022 Law Offices Of Daniel Hunt

Estate Tax Law Changes What To Do Now

What Is The Tax Expenditure Budget Tax Policy Center

Corporate Lobbying Campaign Against Biden Tax Proposals Is Inaccurate Unpersuasive Center On Budget And Policy Priorities

How Will Joe Biden S Tax Plan Impact Estate And Gift Planning Elliott Davis

Reconciliation Bill Capital Gains Tax Proposals Tax Foundation